richmond property tax rate

View more information about payment responsibility. 652019 101518 AM.

Soaring Home Values Mean Higher Property Taxes

Rockingham NC 28379 Business.

. New to Richmond County. Town of Richmond 5 Richmond Townhouse Road Wyoming RI 02898 Ph. A 10 yearly tax hike is the maximum raise allowed on the capped properties.

Parking Violations Online Payment. City of Richmond City Hall 402 Morton Street Richmond TX 77469 281 342-5456. The City Assessor determines the FMV of over 70000 real property parcels each year.

Learn all about Richmond real estate tax. The Richmond Public Library MainCivic Center has limited copies of the Federal 10401040SR booklet as well as the California 540 2EZ and 540 2EZ SP Spanish. Usually new assessments use an en masse strategy applied to all alike property in the same locality without individual property tours.

WRIC Richmond residents will have an extra two months to pay their personal property taxes after the City Council voted to extend the. Property Tax Rates of Richmond NH. 815 am to 500 pm Monday to Friday.

Real Estate Taxes. The following video provides a simplified explanation of the relationship between your assessment value and your property taxes. We have done our best to provide links to information regarding the County and the many services it provides to its citizens.

Building Department. Richmond city collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax. Property taxes are calculated based on the assessment values set by BC Assessment.

The Town of Richmonds property tax due dates are as follows. For all who owned property on January 1 even if the property has been sold a tax bill will still be sent. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate established.

Jun 1 2022 0608 PM EDT. Overview of Virginia Taxes. Amelia County 804 561-2158.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. Pay Your Parking Violation. Town Center Building 203 Bridge St PO Box 285 Richmond VT 05477.

Under the state Code reexaminations must occur at least once within a three-year timeframe. Town of Richmond 5 Richmond Townhouse Road Wyoming RI 02898 Ph. Personal Property Registration Form An ANNUAL.

Rhode Island Emergency Management Agency. Tax Rate per 100 of assessed value Albemarle County 434 296-5856. ALL RATES ARE PER 100 IN ASSESSED.

By Richmond City Council. 3 Road Richmond British Columbia V6Y 2C1 Hours. Tax Sales Next Tax Sale is scheduled for Tuesday September 1st 2022.

We are unable to print instruction booklets. REAL ESTATEPERSONAL PROPERTY TAX RELIEF. Real Estate Property Cards.

The City of Richmond is not accepting property tax payments in cash until March 31 2021 due to pandemic safety measures. 8152021 11152021 2152022 and 5162022. Click Here to Pay Parking Ticket Online.

The median property tax also known as real estate tax in Richmond city is 212600 per year based on a median home value of 20180000 and a median effective property tax rate of 105 of property value. We are able to print and provide limited copies of other forms. Maritza Salazar Created Date.

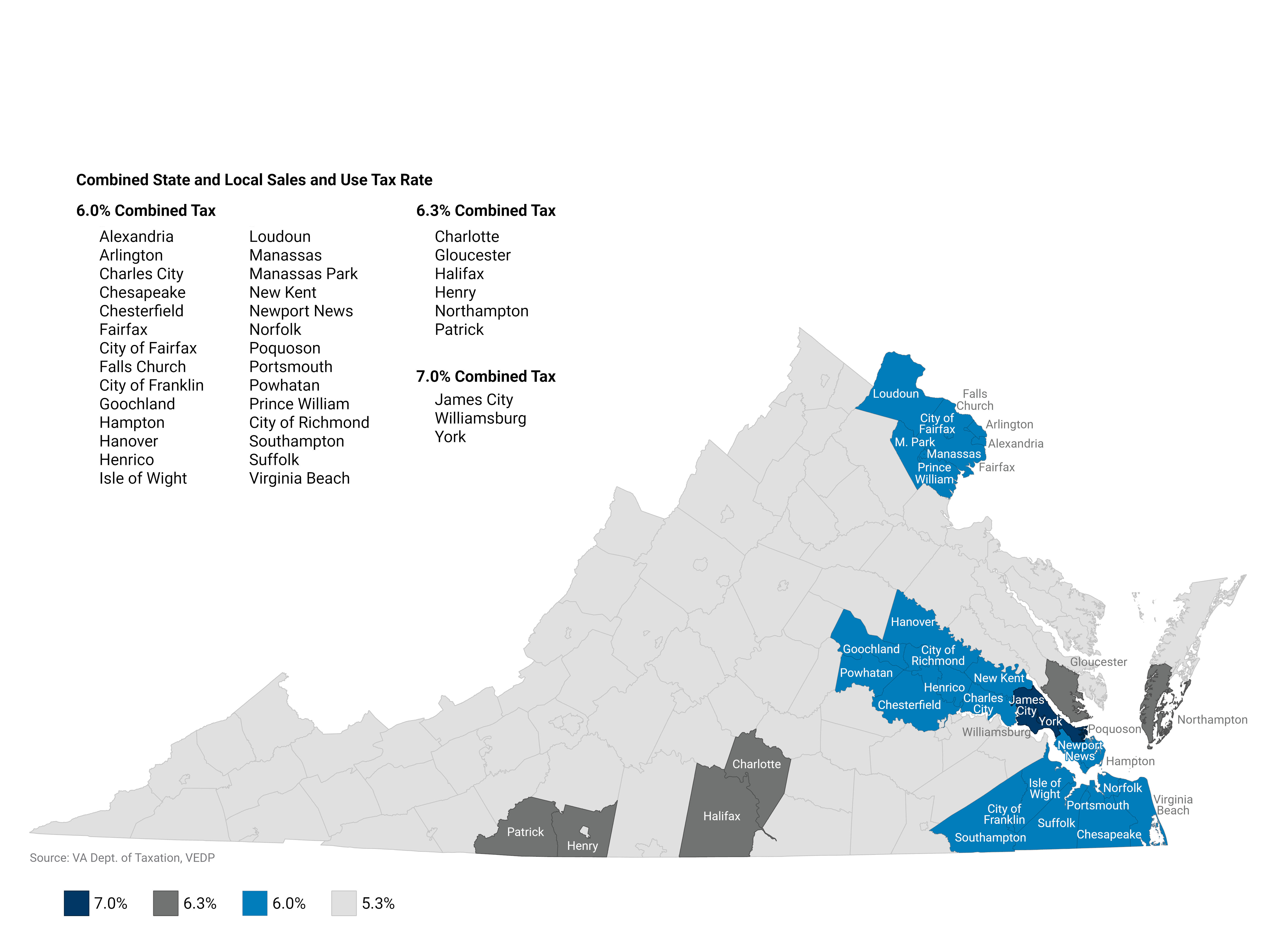

These documents are provided in Adobe Acrobat PDF format for printing. Demystifying Property Tax Apportionment httpstaxcolpcocontra-costacaustaxpaymentrev3summaryaccount_lookupjsp. With an average effective property tax rate of 080 Virginia property taxes come in well below the national average of 107.

June 5 and Dec. City of Richmond adopted a tax rate. 401-539-1089 Staff Directory Helpful Links.

Property value 100000. Property tax payments may be paid by cheque bank draft debit card or credit card a service fee of 175 applies. Personal Property Taxes are billed once a year with a December 5 th due date.

Since home values in many parts of Virginia are very high though Virginia homeowners still pay around the national median when it comes to actual property tax payments. Call 804 646-7000 or send an email to the Department of Finance. Welcome to the official Richmond County VA Local Government Website.

Please request forms at the Reference Desk. Whether you are already a resident or just considering moving to Richmond to live or invest in real estate estimate local property tax rates and learn how real estate tax works. This tax payment portal can be.

1000 x 120 tax rate 1200 real estate tax. Payments can be mailed to. Parking tickets can now be paid online.

Municipal Finance Authority 250-383-1181 Victoria Property Assessments.  This information pertains to tax rates for Richmond VA and surrounding Counties. Land Use Program.

Property Taxes Due 2021 property tax bills were due as of November 15 2021. Property Value 100 1000. Vagas Jackson Tax Administrator 1401 Fayetteville Rd.

Including data such as Valuation Municipal County Rate State and Local Education tax dollar amounts. Real Estate and Personal Property Taxes Online Payment. What are the property taxes in Richmond NH.

Richmond Ky Taxes Incentives Richmond Industrial Development Corporation

Fulshear Simonton Fire Department Proudly Serving Fort Bend County Esd No 4

Richmond Raises Tax Relief As Vehicle Values Surge Wric Abc 8news

About Your Tax Bill City Of Richmond Hill

About Your Tax Bill City Of Richmond Hill

City Of Richmond Adopts 2022 Budget And Tax Rate

Richmond Property Tax 2021 Calculator Rates Wowa Ca

Vermont Property Tax Rates Nancy Jenkins Real Estate

Henrico County Announces Plans On Personal Property Tax Relief

Many Left Frustrated As Personal Property Tax Bills Increase

Virginia Property Tax Calculator Smartasset

Virginia Property Tax Calculator Smartasset

Commercial And Industrial Sales Use Tax Exemption Virginia Economic Development Partnership

Property Tax North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

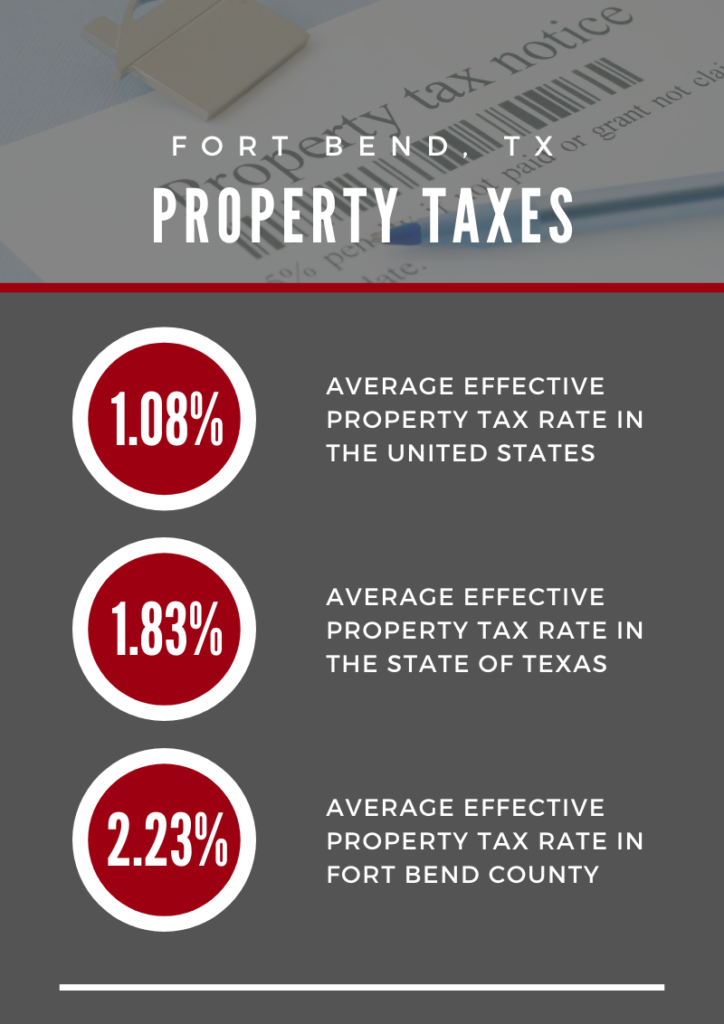

Property Taxes In Fort Bend Tx Bret Wallace Your Local Realtor

About Your Tax Bill City Of Richmond Hill

Virginia Property Tax Calculator Smartasset

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now